Global Markets vs. Political Uncertainty. New order of things and volatility.

1. EDITORIAL

As highlighted by the ETF asset management house Source, in the first Quarter of 2017 different asset classes groups have diverged: equity-like assets and industrial commodities have done well; sovereign debt, IG credit and gold have not. The perspective for the next months should be positive for credit in both spectrum of rating so we are confident on IG, especially for the pick up on prices, and on HY credit with investors that could take advantage of some single names issuers. The investors should also stay positive on Eurozone stocks, emerging market debt (local currency version), emerging market real estate markets (for some particular and evolved investors) and Japanese yen cash.

Recent all-time highs for US stock indices and the prospect of multiple Fed rate hikes suggest confidence is high. The election of Donald Trump seems to have been an important factor, with hopes of tax cuts, higher spending and de-regulation all playing a role.

However, details are sparse and it is hard to see how he can deliver on that wish-list without swelling the budget deficit. We have covered this topic in detail elsewhere and, given the lack of new information, have chosen not to spend too much time on it this time (we have raised our dividend growth assumptions in the US and have nudged up our short term Fed forecasts).

However, despite the apparent blue sky (in the US and elsewhere), we suspect that market and Fed confidence will be tested at some stage during 2017. In particular, European politics could be a concern: we are more wary of Italy than of France.

We are now putting more emphasis on long term considerations and low yields continue to limit the potential for returns over the medium term. We believe the best returns over the next five years will be earned on real estate, equities and credit, with the lower volatility of the latter making it attractive.

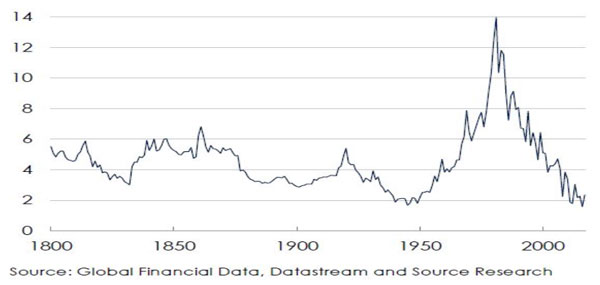

Figure 1

Following the election in the US we have seen largely positive returns and the talk has been increasingly of reflation and Fed tightening cycles. The slight strengthening of the dollar during the last four months (on the back of Trumponomics and Fed hawkishness) reduced global asset returns when converted to USD.

There has been a clear separation of assets in the last four months: yields on equity-like instruments (including high-yield) have gone down, while those on fixed income assets have gone-up (see figure 2 for the 10 yrs US T yield).

Figure 2

This divergence is due to a combination of two factors, both of which are driven by improving economic sentiment: first, forecasts of earnings and dividend growth may have been revised upward, while those of default rates have been lowered; second, the risk premium applied to riskier assets has been reduced.

Within the Eurozone, peripheral markets suffered the steepest gain in yields. For instance, the Italian 10 year yield was up 42 bps over the period considered, while that of Germany gained only 4 bps. Uncertainty about The Italian political situation perhaps explains that divergence. It is noticeable, however, that the French 10 year yield is up by exactly same amount as that of Italy and in many ways it may be fears about French politics that are driving peripheral spread widening.

The one obvious exception to the general rise in sovereign yields was the UK, with 10 year gilt yields down around 10 bps over the period considered (to 1.15%). To be fair, gilt yields had risen sharply since mid-August on the back of a weaker pound and concerns about inflation.

Though emerging market yields were up over the four months, there were some notable exceptions, such as Brazil where a weak economy, falling inflation and central bank rate cuts allowed 10 year yields to fall by around 120 bps to 10.2%.

The ongoing rally in equity markets has made them look marginally more expensive than at end-October (global yield down from 2.6% to 2.5%). This goes against the trend of the last 15-20 years, which has seen dividend yields move gradually higher,

despite the decline in bond yields (see Figure 3).

Figure 3

Our projections allow for a gradual continuation of that trend (though not as rapid as the rise in bond yields) which necessarily limits the return potential.

However, the only valuation problem that we identify is the US market (bloated by Fed QE activity, in our opinion). Figure 4 shows the extent of the problem – the Shiller PE is now approaching 30, a level historically associated with low or negative returns over the following five to ten years.

Figure 4

The last theme on which the investors should focus in the next times is the political risk.

There are a number of important political events awaiting us during 2017. The Trump presidency has boosted some risk assets but has also created a sense of unease, concerning both domestic and international politics. This is perhaps one reason why gold has remained so elevated in the face of higher bond yields and a stronger dollar.

However, the most obvious market concerns have centred on Europe. The Brexit process offers potential for conflict between the UK and the rest of the EU, while upcoming elections in important Eurozone countries could unsettle markets if the result is a referendum about another country’s EU membership.

Next up is the French presidential election (April 23 and May 7) and this is the one that seems to worry most investors due to the potential for a Marine Le-Pen victory. However, we have always doubted that she would win and recent opinion polls have strengthened that conviction. Though she may win the first round of votes, it seems unlikely she will win the second round, no matter who she faces. At present, it looks as though Emanuel Macron will become President but much could change over the coming weeks.

German elections will take place on September 24.

These are of less interest, in that there appears to be no risk of any outcome that could put into question Germany’s membership of the EU. It also seems unlikely that there will be any meaningful change in the governing coalition – we suspect there will be a continuation of the grand coalition between the CDU/CSU and SPD, with perhaps the addition of the FDP which currently looks as though it will re-enter the Bundestag.

What is at stake, however, is the leadership of the coalition. The SPD has enjoyed a notable surge in support since the appointment of Martin Schulz as leader. Indeed the CDU/CSU and the SPD are now closely tied in opinion polls, both with just above 30% of the vote. We suspect Angela Merkel will still be Chancellor after the elections but cannot be certain.

The real concern for us is the situation in Italy. We don’t know when the next election will be, nor do we know the electoral system under which it will be fought (the current system is one that guarantees the winning party at least 54% of parliamentary seats but that is under review). What we do know is that opinion polls suggest the Five-Star Movement has a chance of winning (see Figure 5). We also know that they would be in favour of a referendum to leave the EU, that the ruling Democratic Party is in the process of splintering (between the moderate faction of Matteo Renzi and those more to the left) and that, if needed, Five-Star could perhaps join forces with Silvio Berlusconi’s now EU-sceptic Forza .Italia (which is currently polling at around 12%).

The departure of another large country from the EU would call the European project into question and, more importantly, the departure of Italy from the Eurozone could pose many dangers to financial markets (in our opinion). There are many steps before we get to that situation but we believe the path is more likely to be trodden in Italy than in any other large EU country.

Figure 5

Cristian Rusconi

2. DATA TO WATCH

US

- 07th April: Change in Nonfarm & Manufacturing Payrolls

- 07th April: Unemployment Rate

- 11th April: NFIB small business Optimism

- 12th April: MBA Mortgage Applications

- 12th April: Import Price Index MoM

- 12th April: Monthly Budget Statement

- 12th April: Crude Oil Inventories

- 13th April: PPI Final Demand MoM & YoY

- 13th April: Initial & Continuing Jobless Claims

- 14th April: CPI MoM & YoY 08th April: DOE Crude Oil Inventories

- 17th April: Empire Manufacturing & NAHB Hosuing Market Index

- 19th April: FED’s Beige Book Release

- 20th April: Bloomberg Consumer Comfort

EU

- 7th April: Industrial Production SA MoM & WDA YoY [GER & FRA & UK]

- 7th April: Manufacturing Production SA MoM & WDA YoY [FRA & UK]

- 7th April: Retail Sales MoM & YoY [ITA]

- 11th April: ZEW Survey Current Situation, Survey Expections [GER]

- 11th April: Industrial Production SA MoM & WDA YoY [EZ]

- 11th April: CPI MoM & YoY & RPI MoM & YoY & PPI MoM & YoY [UK]

- 13th April: CPI MoM & YoY [GER & FRA]

- 19th April: Trade Balance SA & NSA [ITA]

- 19th April: CPI MoM & YoY [EZ]

- 20th April: Consumer Confidence [EZ]

- 20th April: PPI MoM & YoY [GER]

DISCLAIMER: The only purpose of this document is to provide information about the current markets. This newsletter is prepared for information purposes only and should not be interpreted as investment advice. It does not constitute an offer or invitation by Framont to any person to buy or sell any security or instrument or to participate in any transaction or trading activity. It does not want to solicit the subscription of financial products and services, which must only be done after reading and understanding the Prospectus and any other related information. Framont & Partners Management Ltd verified very carefully the information contained in this document, but it does not ensure that such information is complete and correct and is not responsible either about the use that third parties make of such information or about any los s or damage that may arise after that use. Information included in this newsletter is considered as current as at the date of publication , without regard to the date on which you may read or be provided with such information. We do not accept any liability arising from any inaccuracy or omission in the information on this website. Every investor should always read the Prospectus and any other available information before making an investment decision. Furthermore, the yield or other terminology used to indicate the return is not guaranteed and may go down as well as up. The performance figures quoted (if any) refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. An investment product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. More details about Framont are available on the website www.framontmanagement.com.