Financial Markets in Flux: Analysing October’s Index Performances, Geopolitical Impacts, Earnings, and Future Projections

Index performances

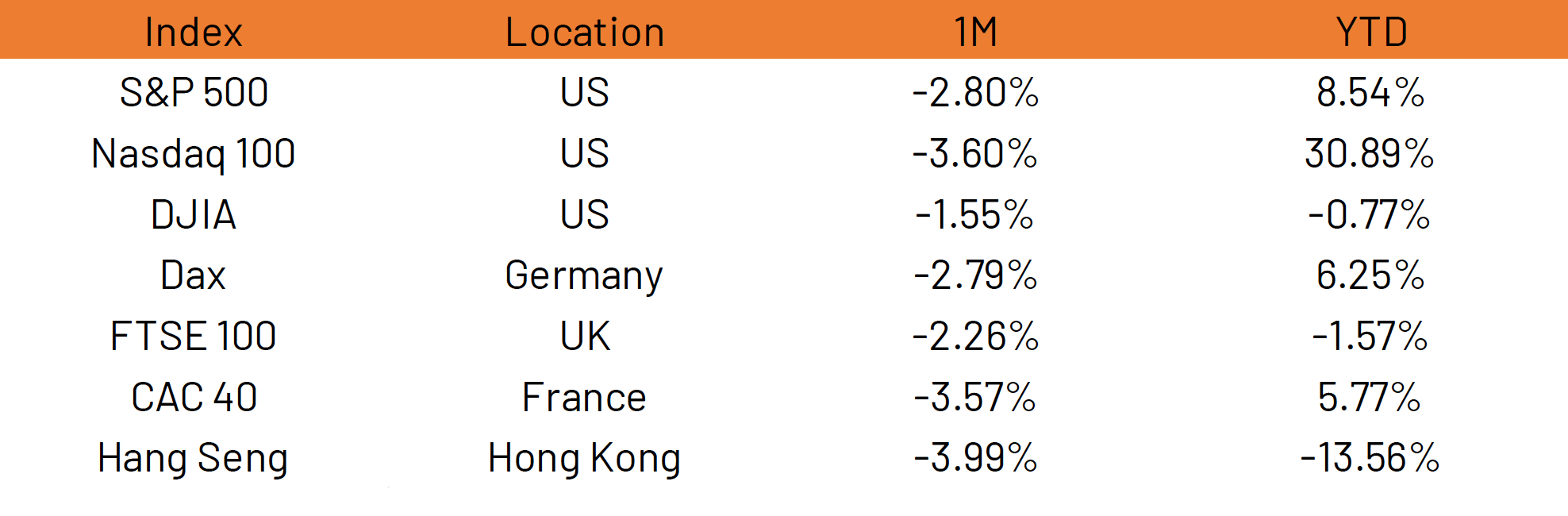

October dug in on Septembers negative performance and equity markets dropped further from the highs this year. All major equity indices fell in October, in the US the tech heavy Nasdaq fell -3.6% and the S&P 500 dropped -2.6%. As you can see from figure 1 the 2023 performance has largely been positive for equity markets, most gains coming from the first half of the year. Western markets (US&EU) are have been in correction pattern since the end of July. Various contributors such as the geopolitical crisis in the middle east, surging bond yields and rates being anticipate to stay higher for longer explain why markets have slumped in the previous 3 months.

Figure 1

Q3 corporate earnings were reported in October. On the most part results were positive with Microsoft, Amazon and Netflix performing well. Tesla struggled along with Alphabet which was hammered by markets post earning release. Thursday 2nd November will see Apple release Q3 earnings, as the last of the “magnificent 7” to report so this will be significant and a poor performance may cause further unrest.

The flight to safety

October, a geopolitical crisis unfolded as militant forces engaged in conflict on Sunday, October 7th. While historical precedence suggests that geopolitical events typically have a transient impact on financial markets, this crisis adhered to that pattern, albeit with a noticeable effect. The most immediate consequence was a significant decline in global risk sentiment, which acted as one of the primary drivers of change. This fall in risk sentiment was a key factor that contributed to the surge in bond yields.

Figure 2, Chart from Bloomberg

More specifically, US 10-year treasury yields approached the 5% threshold later in the month, reaching their highest levels since 2007. The convergence of this surge in yields with the recognition that interest rates are expected to remain elevated for an extended period further exacerbated the situation. It is important to note that the rise in treasury yields simultaneously increased the “risk-free rate,” which, in turn, diminished the attractiveness of higher-risk asset classes such as stocks in investors’ portfolios. This interplay underscores the intricate relationship between geopolitical events and financial markets, emphasising the critical role of risk sentiment in shaping market dynamics.

Commodities

Oil jumped as expected in October, Brent futures rose above £90 per barrel as concerns grew that the conflict may have an impact on oil supply from the largest producing oil region. A similar situation arose when Russia invaded Ukraine, however one must be careful when drawing comparisons between the two, when Russia invaded Ukraine oil demand was much higher, and therefor the restriction in supply was worsened by Russia’s invasion. If conflict in the middle east does begin to involve surrounding nations then we can expect a further increase in oil prices, especially seeing that neither Israel or Palestine are major oil players.

Gold jumped 8% in October, buoyed on by investors seeking a safe haven for their asset after the middle eastern conflict. Gold continues to hover around the $2000 mark in anticipation of the FEDs outlook which will be released 1st November. It is possible that a more hawkish federal outlook may have a slightly negative influence on Gold.

Interest rates & inflation

In the US Interest rates held steady in October, and it is anticipated the Fed will hold rates again in November. Better than expected US data may allow the Fed to justify another rate hike, but that remains to be confirmed. On the 1st November, the FED will announce their decision on whether to hold interest rates in November. What investors will look for is the FEDs outlook, market participants will dissect every sentence in an attempt to gain hints on future monetary policy, and whether Powell will keep a December rate increase on the table.

Figure 3 – ECB Interest rates 1999 – present (Bloomberg)

In the EU inflation came in lowest since July 2021, October prices grew by 2.9% compared to 4.3% a month earlier. It is likely what this will mean is that the ECB will be done raising interest rates to combat high inflation levels across the EU. The main policy rate currently sits at 4% following the banks longest streak of rate hikes in its 25 year history.

What’s to come?

The million dollar question. In November we’ll have a clearer understanding of the federal reserve’s outlook, a more hawkish outlook with increased likelihood of tightening will likely be negative for equity markets. A more Dovish Federal outlook will have the opposite effect.

If we see continued escalation in the middle east conflict, specifically if other countries are drawn into the conflict then we can expect increased volatility in markets and an increase in oil thanks to further concerns regarding supply. This will likely cause investors to put their assets in safe havens.

We still have Q3 earnings being reported, Apple will take the stand on 2nd November which will be watched closely by markets, it could be the case that the negative performance has a wider effect on US equities.

This marketing document has been issued by Framont & Partners Management Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country, or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation, or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions, and comments of Framont & Partners Management Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Framont & Partners Management Ltd entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Framont & Partners Management Ltd. does not guarantee its completeness, accuracy, reliability, and actuality. Past performance gives no indication of nor guarantees current or future results. Framont & Partners Management Ltd. accepts no liability for any loss arising from the use of this document.